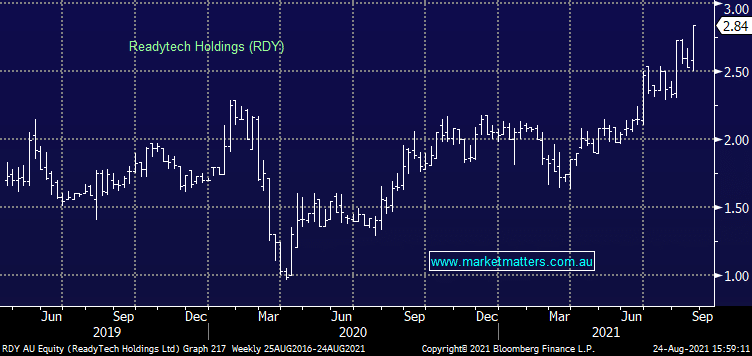

FY21 Result: The impressive education technology business posted a solid FY21 result today (~1% above Shaw’s expectations) however they outlined a path of strong organic revenue growth over the coming 5 years which speaks to increasing confidence from management and line of sight for the business. Shaw’s analyst Jules Cooper had this to say on the result… FY22 guidance implies an acceleration in organic growth to 18% vs 13% achieved in FY21 on a like-for-like basis. In addition, RDY have provided a new FY26 organic revenue target of +$125m, which is approx +20% ahead of our prior forecasts and demonstrates management’s growing confidence in the business and outlook. We have upgraded our FY22-24 revenue forecasts by 5-14% and EBITDA by 3-13%. We upgrade our PT to $3.60 (was $3.00) and believe the re-rate can continue.

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish RDY

Add To Hit List

In these Portfolios

Related Q&A

buying stocks in emerging portfolio

Which Emerging Company does MM prefer SLX, RDY or SRG?

Question on IPO’s

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.