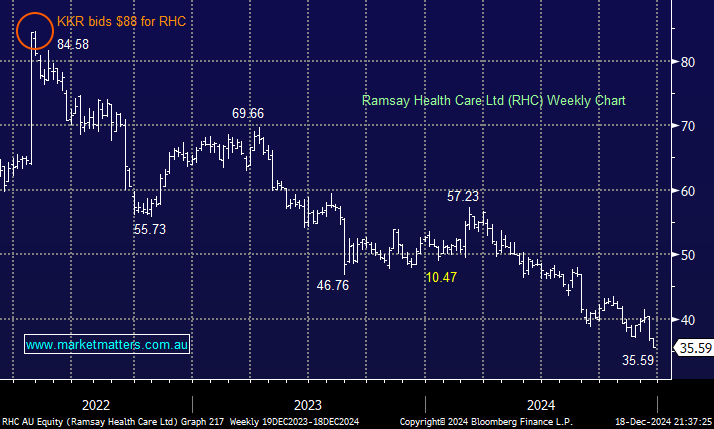

We discussed Atlas Arteria (ALX) earlier in the week, a business that’s struggled over the last few years, not helped by its significant exposure to France – a country still in political turmoil. Similarly, RHC shareholders must rue the day RHC expanded into France in 2010 when it initially acquired a 57% controlling interest in Générale de Santé, a leading operator of private hospitals. This holding was the main stumbling block between KKR and the “unhelpful” Ramsay board back in 2022 following the initial $88 bid from the international private equity giant; the shares are trading around 60% lower than the bid today, and we ponder if the board still feel the bid undervalued the company’s long-term growth potential.

The no 2 player in Australia, Healthscope, had been taken out in 2019 by Brookfield for $4.1bn cash, beating Melbourne private equity firm BGH Capital and AustralianSuper in the process. They are now in a world of pain as they try to renegotiate $1.6 billion in debt at a time when private hospitals are struggling. Profits were hit hard during the pandemic when elective surgeries dried up, and costs are now higher than ever. The hospital operators are blaming structural problems with the health system and say they are being squeezed by private health insurance funds. This is probably true but there are multiple stakeholders in the mix and negotiations are very complex.

Ultimately, the sector has multiple challenges that need addressing and given the experience Brookfield has had owning Healthscope, we doubt there will be a line up of other private equity backers looking to emulate their experience.

- We see no reason to fight this ingrained downtrend; the company is in a very different position than in 2022.