RMS -8.72%: another gold miner that has been forced to downgrade near the end of the period as conditions become increasingly more difficult. They’ve blamed the poor weather, COVID & influenza as well as lower grade when putting through a small downgrade to production guidance for the full year today, from 260-260koz down to 255-260koz. For the most part, these issues aren’t company-specific and they will pass with time. Gold miners will also need a commodity tailwind to get investors interested again. One positive was that RMS didn’t push costs higher, though they are expected to land at the top end of the previously guided $1,475-1,525/oz range.

scroll

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

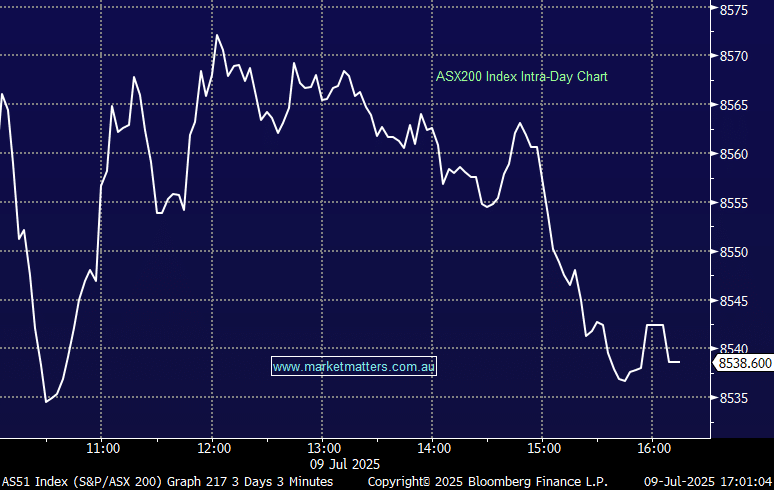

Wednesday 9th July – Dow off -165pts, SPI down -7pts

Wednesday 9th July – Dow off -165pts, SPI down -7pts

Close

Close

MM prefers RRLS & NCM in the gold stocks

Add To Hit List

Related Q&A

Gold stocks & ETfs

Gold juniors miners

Thoughts on the 2nd tier gold shares please

A question on Bitcoin & Ramelius Resources (RMS)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 9th July – Dow off -165pts, SPI down -7pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.