A tough day yesterday for the WA based gold producer after they rejigged their mine plans for the Mt Magnet Gold Mine located around 500 km northeast of Perth in the Murchison Goldfield of the Yilgarn Craton. The key takeaways in the updated plan (compared to the March 2024 Plan) are lower production and higher all-in sustaining cost (AISC) in the early years of production to facilitate higher rates of production in later years (FY32 to FY35). Specifically, The lower production and higher costs are a result of replacing higher grade Eridanus underground ore previously scheduled in FY26 with the larger Eridanus open pit cutback in FY27 before production significantly increases as the mined grade at Eridanus increases with depth.

- The change is clearly a short-term negative, and we’ll see brokers rejig earnings assumptions for FY26 & 27, however, we believe the market is being very short in its thinking and there does appear to be a good reason for this tweaked strategy.

The updated mine plan has optimised a fully utilised mill for a 17 year period, while the plan also includes an expansion of milling capacity from 2Mtpa to 3Mtpa (FID in September 2025 quarter with constriction to begin in the December 2026 quarter), costing an additional $95m. This will ultimately generate a higher run-rate over a longer period, improving the economics of the development, with management saying the upgraded equipment will reduce mill operating unit costs from AU$28.17 per tonne in FY24 to AU$21.42 per tonne by FY28.

The balance sheet remains strong with cash and gold of $501.7 million as at 31 Dec. Ramelius also said it expects to generate more than $270 million in underlying free cash flow in the 2H25, assuming an A$4,000 per ounce gold price.

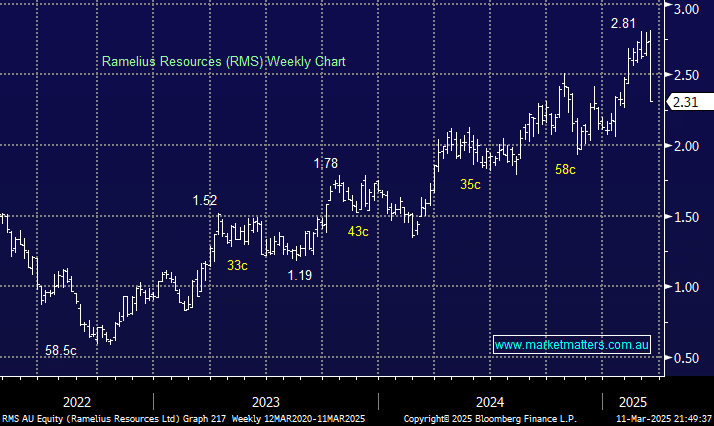

- For those with a medium-term view, we believe the sell-off in this quality mid-tier gold company could present an opportunity once the dust settles.