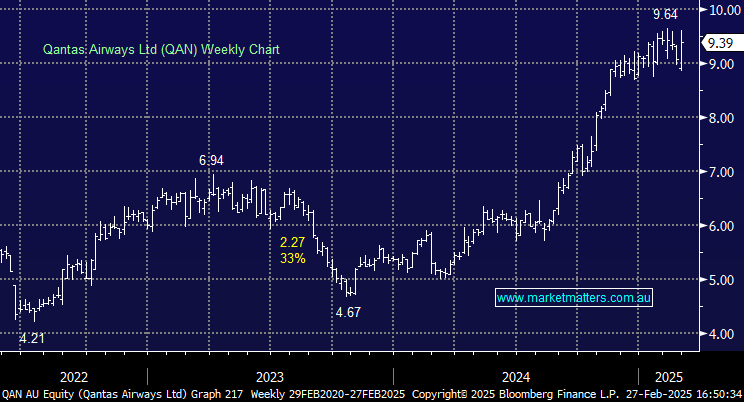

QAN +5.62%: An in-line 1H25 result saw the shares rise as much as 9% higher with a surprise capital return underpinning the positive move.

- 1H25 revenue pf $12.13 billion (+9% yoy) vs. $11.86 billion estimate

- 1H25 underlying profit-before-tax of $1.39bn, +1% ahead of consensus

- FY26 capex guided to $4.1bn-$4.3bn

- Fully franked dividend of 16.5cps plus a 9.9cps special dividend

The 1H performance was driven by both Qantas and Jetstar brands, with Jetstar particularly impressive as it posted a 15% beat to earnings $439m vs. $380m. The decision to pay out their first dividend since 2019 with a special on top is a smart move by management costing them ~$400 million but giving investors a reason to stick around, though we’d prefer to look through the sugar hit given the looming ~$6 billion in capex due over the next 18 months to update the fleet.