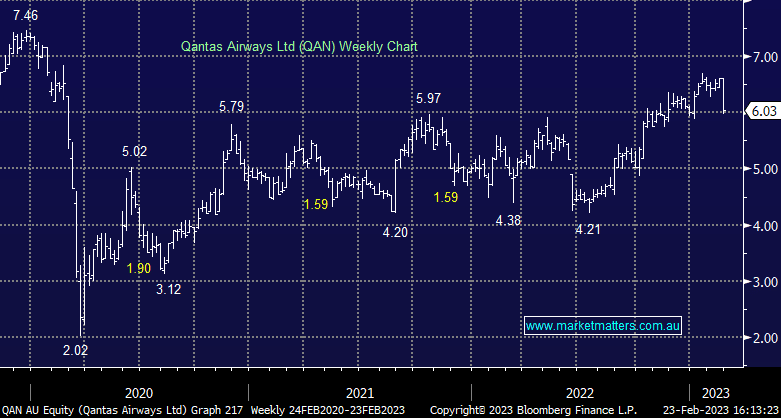

QAN -6.8%: the flying kangaroo was brought back to earth today after a tough reaction to their 1H results. Underlying Profit Before Tax (PBT) of $1,428m was near the top end of the $1.35-1.45b guidance range, while EBITDA was in line and they even announced a $500m buyback. The issue came with guidance as the company failed to provide PBT targets for the second half and lifted capex guidance for the full year by 20% to $2.6-2.7b as well as bumping up medium-term fleet capex by $2b. Other guidance looks largely in line, however, the market will also want to see some better cost control after non-fuel costs came in above expectations for the 1H.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

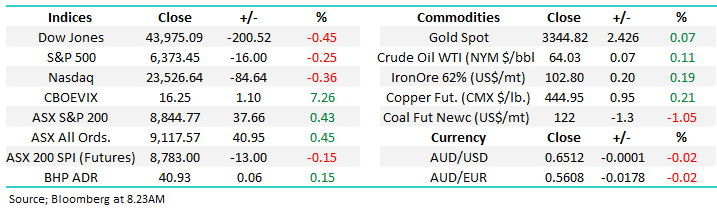

Tuesday 12th August – Dow off -200pts, SPI down -13pts

Tuesday 12th August – Dow off -200pts, SPI down -13pts

Close

Close

Monday 11th August – ASX +32pts, JBH, CAR, IRE

Monday 11th August – ASX +32pts, JBH, CAR, IRE

Close

Close

MM is neutral QAN ~$6

Add To Hit List

Related Q&A

MM’s view on tourism stocks

Is Qantas turning around ?

Does MM plan to buy Qantas shares (QAN)?

Does MM like the AIZ rights issue?

MM views on Qantas (QAN) & Kogan (KGN)

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 12th August – Dow off -200pts, SPI down -13pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 11th August – ASX +32pts, JBH, CAR, IRE

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.