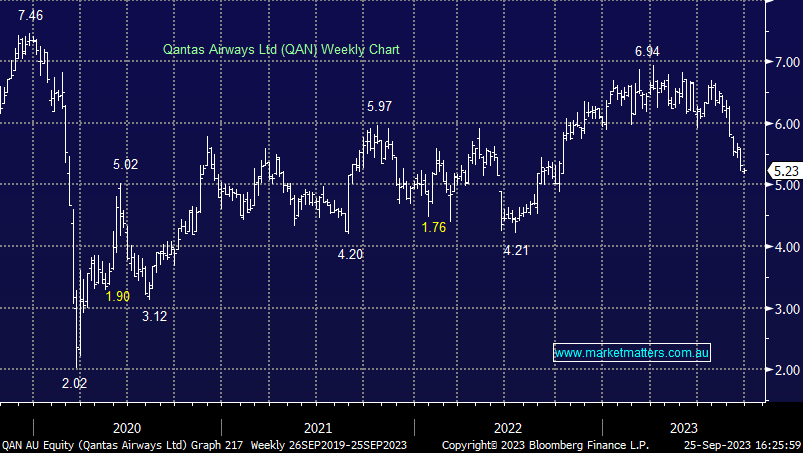

QAN -1.51%: the troubles at the flying kangaroo continued today with more money being thrown at upgrading the customer experience and oil prices weighing on earnings. The airline will spend an additional $80m to address ‘pain points,’ as they put it, on better contact options, better in-flight catering and improving frequent flyer availabilities, just some of the issues that have been underinvested for some time. Fuel prices are expected to have a $200m impact on the first half for a total cost of $2.8b, while FX will knock another ~$50m off the bottom line. The announcement looked to soften the blow by saying trading conditions for the first quarter had remained robust, though shares still closed at 11-month lows.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM has no interest in QAN

Add To Hit List

Related Q&A

Qantas (QAN)

MM’s view on tourism stocks

Is Qantas turning around ?

Does MM plan to buy Qantas shares (QAN)?

Does MM like the AIZ rights issue?

MM views on Qantas (QAN) & Kogan (KGN)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.