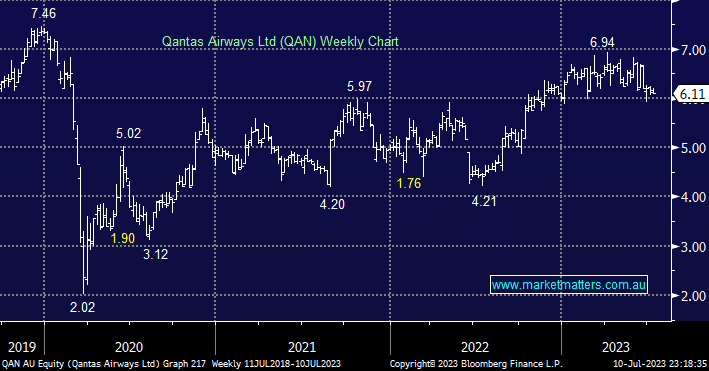

QAN has recovered strongly post-COVID but it still screens cheaply trading on an Est. 6.4x earnings valuation for FY23, this household name has evolved from the shocks of 2020 as a leaner business with better margins e.g. they are aiming for 18% in the domestic business vs ~13% in FY19 while the international side is also improving. At a glance, the stock is offering compelling value, well below the long-term average, due to concerns around a significant near-term CAPEX spend to revitalize its fleet and lounges, although a company presentation in May attempted to allay these concerns.

In our view, QAN is well positioned moving forward although if we experience a recession it will obviously impact demand but that’s one good aspect of stock already trading on the cheap side. Additionally, even with the necessary capex on the horizon, there’s likely to be room for a $500m buyback FY24E which should be supportive of the stock.

- We like QAN into further weakness below $6.