PME is an Australian healthcare technology company that develops and supplies medical imaging software and services to hospitals, diagnostic imaging groups, and healthcare providers worldwide – it’s more of a tech than a healthcare stock. The company has enjoyed four major contract wins in 2025, including UCHealth, a $170 million, 10-year agreement, covering a network of 14 hospitals and including its cardiology imaging module, and BayCare (Florida), a $53 million, 7-year contract to implement its imaging platform. With margins of 70-80% it’s easy to see how the company’s ~$32bn valuation has outstripped short-term revenue and profitability, closing at 280x Est FY25 earnings yesterday, leaving little room to disappoint on any level.

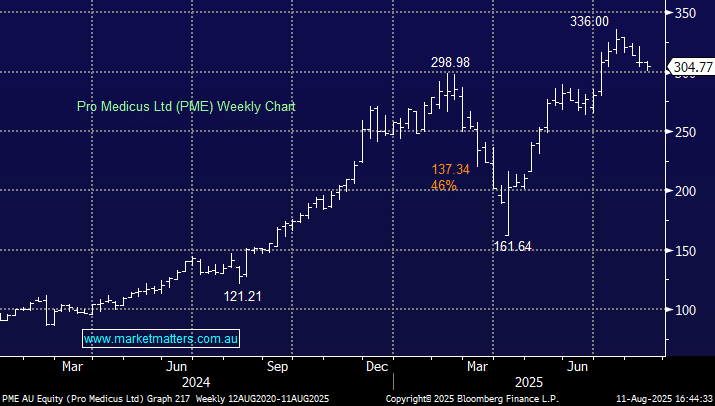

- We see PME as a coin toss around $300 ahead of Thursday’s result – not doubt it will be a good one, but whether or not it will be good enough, is the key question.