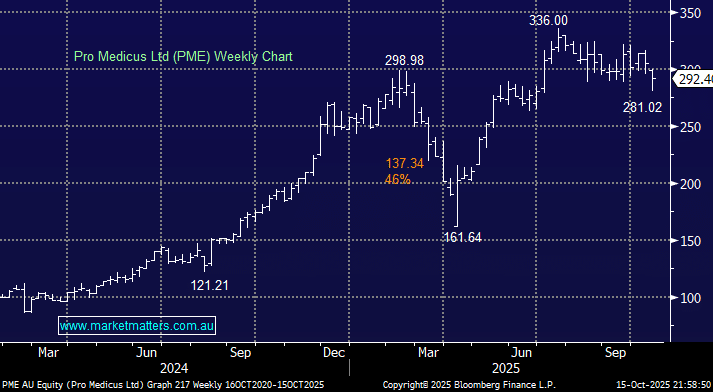

PME bounced back +1.9% on Wednesday after correcting 16% over recent months. In very similar fashion to CBA this momentum play lost support and fell away as the “hot money” went for the exits. During FY 2025, the company secured over $520 million in new agreements, plus $130 million in key renewals, including an $98 million deal with Mercy Health, which pushed the stock above $330. It’s maintained the momentum so far in FY26, with it on track to deliver double-digit revenue growth after securing a $170 million / 10-year deal with UCHealth.

With operating margins above 70%, the business converts most revenue into profit, enabling strong R&D investment, acquisitions, and share buybacks. We like a lot about the business, except the price. A few quiet months with little in the way of new contract wins could easily see the stock retreat another 10%.

- We like PME as a business, but its valuation remains a concern and will likely leave us on the sidelines unless we see further weakness.