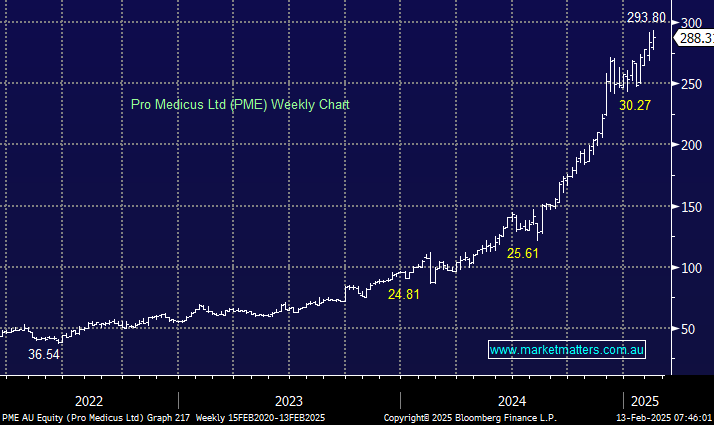

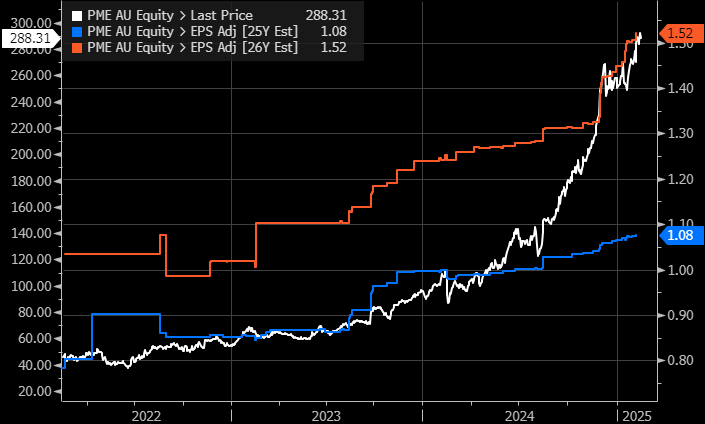

PME has been one stock that has driven higher over recent years in the face of a huge valuation. Still, it has continued to kick goals, winning new contracts almost as regularly as Sydney rain of late, taking earnings estimates ever higher and justifying a P/E of ~270x for FY25.

This is undoubtedly a great business, but a few quiet months in terms of new deals could easily see another $25-30 pullback. We’ve already witnessed three in less than 18 months. MM has written this a bit lately, but we don’t like the risk/reward towards PME into new highs.

- We like PME, like all of the market, and are very keen on the software & IT business for the medical industry – the stock remains in our Active Growth portfolios Hitlist.

- NB: PME reports results today