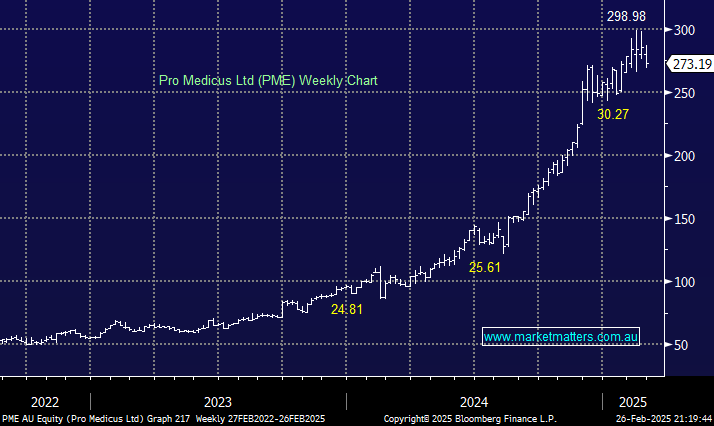

Recently, we have seen several high-flying stocks pullback after reporting, even after delivering solid reports, the market was priced for more and crowded momentum trades can often produce sharp corrections, especially at the pointy end of town where valuations are lofty:

- JB Hi-Fi (JBH) -16.5%, CAR Group (CAR) -11.5%, Commonwealth Bank (CBA) -11.3%, Pro Medicus (PME) -10.2%, and Aristocrat (ALL) -8.5%.

Health imaging technology company PME was one of the market standout performers in 2024, and its report was equally impressive this month with underlying profit before tax of $69.9m, up 42.9% YoY. The company remains debt-free, holding sufficient cash reserves to fund its anticipated growth as it seeks to expand its presence in North America, Germany, and Australia. While PME doesn’t give forward guidance, they did speak encouragingly about a strong sales pipeline.

Valuation is the only concern that MM has with PME, and it has kept both ourselves and many investors on the sidelines. While an Est FY25 P/E of 246x is daunting, it can quickly be justified if this $28bn business continues its growth trajectory. Also, in lots of ways, PME is more of a tech stock that operates in the healthcare space, which, as subscribers know, is a space that often commands far higher valuations as growth can be explosive.

- We remain potential buyers of further weakness in PME with the stock in our Active Growth Portfolio Hitlist.