We have discussed health imaging technology company PME several times in recent months, delivering the same message: it’s an exciting growth stock but too expensive. However, although it’s still trading on an estimated valuation of 172x for FY25, it’s finally trading back near its average valuation of recent years. As a business, it has come in leaps and bounds, arguably making it cheap, assuming the US economy doesn’t close for business over the coming years.

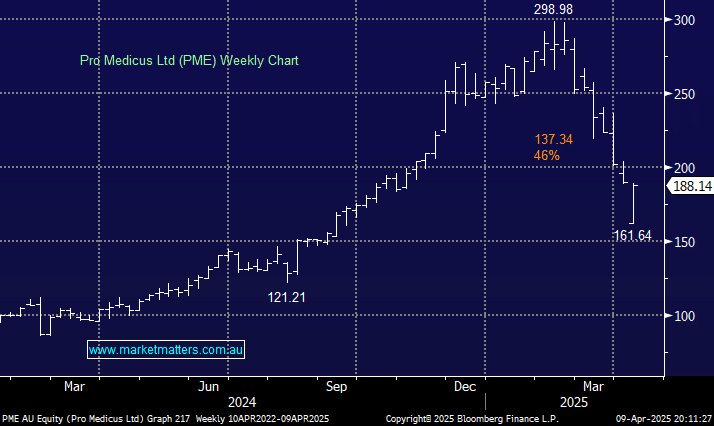

- We like PME as an aggressive, high-beta stock after its 46% plunge from its dizzy heights in February.