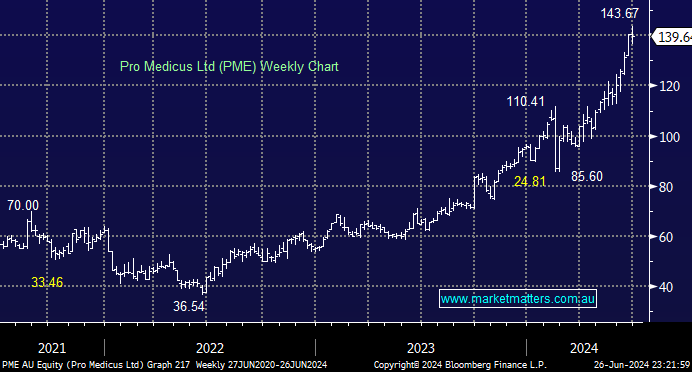

We have been bullish but too conservative towards PME through 2024, but this medical software business is going from strength to strength; it’s the sector standout this year, advancing over 45% year-to-date. The stock is ridiculously expensive on today’s numbers, but its valuation will fall over the coming years if earnings growth continues as its impressive pace. From a risk/reward perspective, ideally, we like PME ~$135, less than 5% lower.

- We can see PME trading higher over the coming months/years, but volatility will likely increase in line with its valuation. It’s about where not to buy PME.