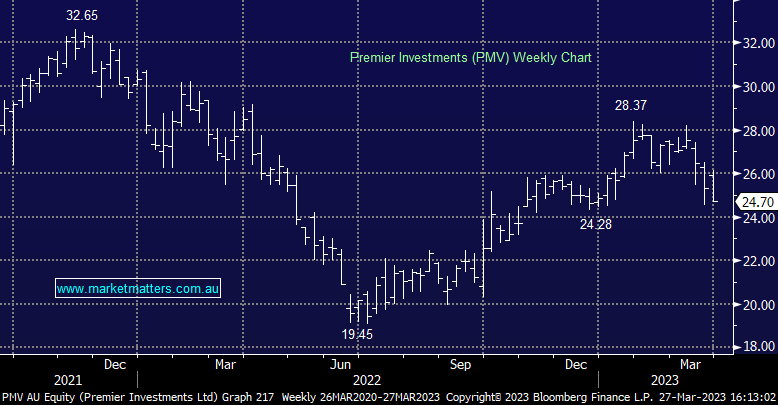

PMV -2.49%: the retail group reported 1H numbers today which were well ahead across most metrics, however, the initial rally in its shares was sold into, ending the session lower. Sales were a ~15% beat to expectations while Retail EBIT was around 5% ahead of the market. The company’s balance sheet is in great shape with ~$400m cash along with significant investments in Myer (MYR) and Breville Group (BRG), giving the company plenty of flexibility to look at further growth through M&A while they continue to execute on their store roll-out and geographical expansion plan. The company will pay a 54cps dividend (inline) and a 16cps special dividend, both fully franked. Trading for the first 6 weeks of the new half was also strong, up 7.7% on pcp. The only issue we had with the result was lower margins, mostly as a result of their FX exposure while manageable costs were controlled well.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish PMV, targeting ~$30

Add To Hit List

Related Q&A

Premier Investments Ltd (PMV)

Dicker Data (DDR) and Retailers

Refinitiv Data and AIC Mines (A1M)

PMV and 360

Your general thoughts please

What is the base cost of the Myer shares issued

Myer (MYR) and Premier Investments (PMV)

SUL vs. PMV?

Do you like Nick Scali (NCK) and retail into 2024?

Retail Stocks – Are they a buy yet?

Thoughts on SIQ & SUL please

Thoughts on retailers PMV & WES please

Does MM like currently PMV, LOV &/or SUL?

How does MM view retail and other sectors being sold off?

MM’s thoughts on LOV, PMV and SUL please

Would MM buy Lovisa (LOV) at current levels?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.