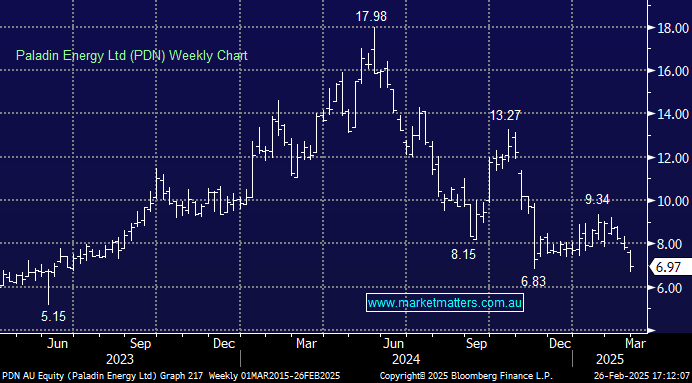

PDN –4.39%: Released 1H25 results that were largely in line with market expectations; net neutral as other names in the sector were sold down in a similar fashion amid uranium spot price weakness.

- US$77.2m in revenue

- Produced 1.3Mlb of uranium in the half and sold 1.1Mlb to customers

- On track to meet the revised production guidance of 3.0– 3.6Mlb for FY2025

- 1H25 average realised uranium price of US$68.8/lb, with a cost of production of US$42.1/lb

- Free cashflow from operations post capital expenditure of US$6.4M

- US$165.8m in unrestricted cash and short-term investments + undrawn revolving debt facility of US$50m.

Beyond the production numbers which are solid, the result highlights a sound balance sheet and cash-flow positive operation at Langer-Heinrich. Sentiment for uranium right now is poor, due to the potential end to the Russia-Ukraine war and what that might mean for Russian enriched uranium supply coming back to market. We are cognisant of this risk however the long-term growth drivers of uranium demand still outweigh the jitters of a short-term supply increase.