We believe the uranium sector is entering the next phase of its recovery after the major downturn post-Fukushima back in 2011. There’s been a distinct lack of investment in new mines over the past 12 years which has resulted in a structurally undersupplied market with the subsequent drawdown of inventories leading to a meaningful commodity price recovery – the spot uranium price has increased to around US$57/lb and in our view is heading significantly higher over the next two years. Nuclear Energy is recognised by many countries as an essential element of the clean energy mix, which should enable nuclear power to increase its current footprint from ~10% of global electricity. We discussed our bullish outlook towards uranium in our Resources into FY24 webinar.

The Australian government continues to talk down nuclear as a local option, it’s good for business and votes! However, there is an increasing number of business leaders calling on nuclear as a viable option for the replacement of baseload coal-fired electricity. This isn’t going to move the dial globally but it may impact sentiment towards the local stocks.

- Australia may be anti-nuclear but global heavyweights such as the US, China, France and again Japan continue to view it as a major efficient clean fuel source moving forward.

- Uranium already makes up almost 50% of clean energy for the US and is now regarded as a critical mineral in Canada.

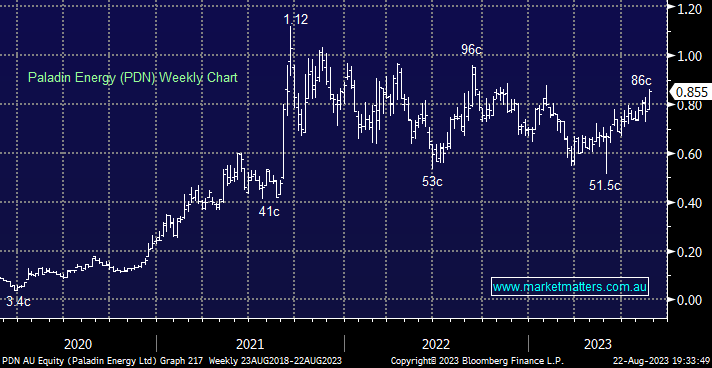

Existing low-cost producers such as Cameco and Kazatomprom can generate reasonable returns at uranium prices of US$40-50/lb while Greenfield restarts including Paladin (PDN), Boss (POE), Peninsula (PEN) and Lotus (LOT), require uranium prices in the US$50-65/lb range to generate an adequate return. Lastly, Brownfield new projects such as Bannerman (BMN) require uranium prices in the US$70- 85/lb to incentivise the investment required to build the new capacity – Paladin (PDN) is our preferred sector play as it looks to restart Langer Heinrich in early CY24

- The spot uranium price has rallied from its post-Fukushima low of ~US$20/ lb to around US$57/b today and we believe looming tight supply will push prices up towards $US80/lb.

- We currently own Paladin (PDN) in the Emerging Companies Portfolio