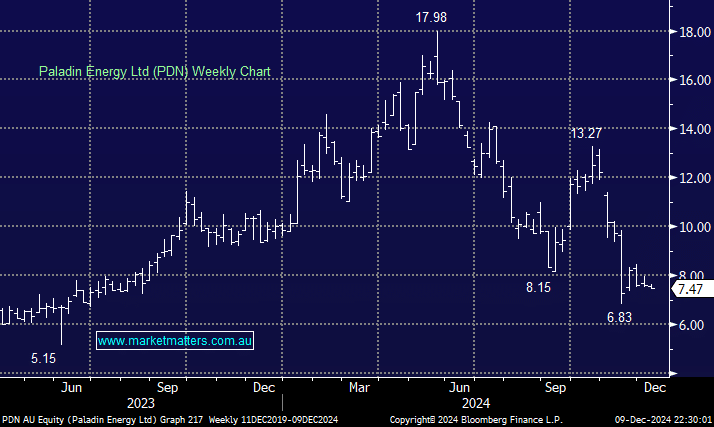

This morning’s pick feels like entering the lion’s den and a very different proposition to Catapult (CAT) 3-months ago. PDN is down more than 50% from its 2024 high, but we believe it’s standout value around $7.50. We have discussed PDN at length through 2024 primarily because we are very bullish on the uranium/nuclear theme over the coming years, a view that’s paid dividends in another MM portfolio: Cameco (CCJ US), which we hold in our International Companies Portfolio is up well over +30% year-to-date while PDN has fallen 24% – unfortunately not an uncommon theme across the ASX.

In simple terms, we believe the markets derating of PDN has been a huge overreaction, although we note that some don’t agree, with over 15% of PDN now short-sold.

- In October, the stock was sold off heavily after PDN released its September quarter update. The market punished PDN for lower production/sales volumes and higher costs, yet the issues look to be largely one-offs that shouldn’t persist in the medium-long term.

- Then in November, the market wiped $800m off the market cap of PDN in one day when they lost ~1mlb of uranium resource (from low grade in the stockpiles), only an estimated A$60m in value!

PDN’s balance sheet is fine—there is enough liquidity, and Paladin’s cash flow is now positive. They also have US$55m in cash and US$55m in available debt funding. It cannot take a trick now, but lows are formed when things look their worst.

- We can see PDN testing its $13 swing high in the coming quarters after recent panic-like selling.