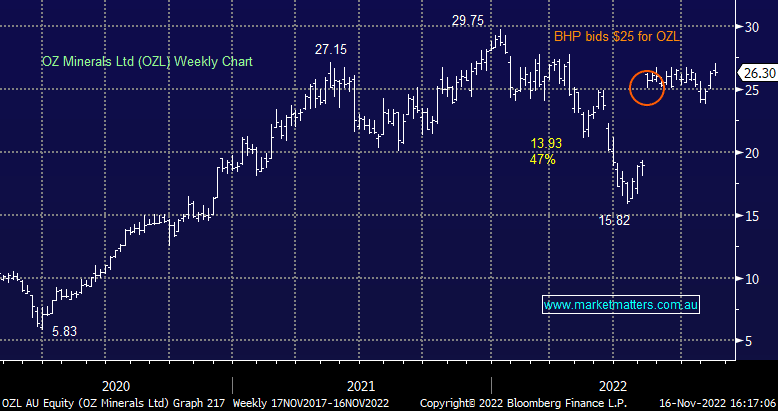

OZL (halted): was in a trading halt today pending the announcement of a change of control transaction – a takeover in other words. As we know, BHP bid $25 a share for the Copper miner and that price was rejected without giving BHP the chance to look under the hood. Two things could be happening here:

- BHP could have made a new bid which is clearly ‘Material’ for OZL (hence the trading halt), but not for BHP given it would represent less than 5% of their market cap, however, while the letter of the law says BHP don’t need to be halted, the profile of this deal in Australia is big and we would have thought BHP would stop trading while the news was being worked through.

- This brings up the prospect that another suitor has joined the fray, whether that’s Glencore or some other global player, it would certainly make things more interesting and create more tension in the price

Our well-regarded (Shaw) analyst on OZL Peter O’Connor wrote this recently…. To get to GAME point BHP may need to think closer to $40/share. Our recent missive, which joined the dots to peer RIO vs TRQ bid – highlighted that a $40/share valuation was not out of the question.