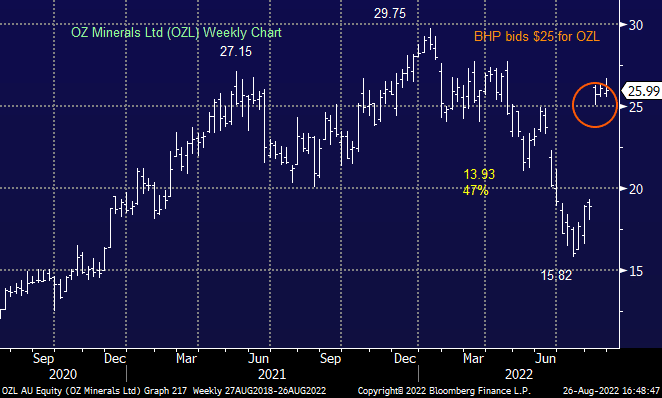

OZL –0.76%: A weak result from OZL today with sharply lower financials compared to 2021. These were well flagged in recent quarterly updates however they’re not the numbers to report when you’re trying hard to squeeze a higher price from suitor BHP. Key financial headlines included, 1H22 NPAT $109.2M vs year-ago $268.6M, Revenue $908.6M vs consensus of $938.6M & EBITDA $358.3M vs consensus of $368.2M. The numbers all a little soft however the CEO Andrew Cole spent most time today talking about the growth pipeline putting forward a very strong argument why BHP should be paying more than the $25 they initially proposed.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM recently trimmed OZL, but still remain long in our Flagship Growth Portfolio

Add To Hit List

Related Q&A

What are MM’s current thoughts towards OZL and TPG?

Is OZ Minerals (OZL) a buy?

Does MM think BHP & SFR are buys for battery metals?

Does MM like S32 & / or PLS?

OZL

Thoughts on Lithium & Gold

Identifying stocks to sell

This weeks Commodities Webinar

Should I sell Oz Minerals (OZL)?

Outlook for base metals

MM thoughts on Copper & SFR

Should we get off the reflation trade?

WPL vs BPT, NCM vs OZL

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.