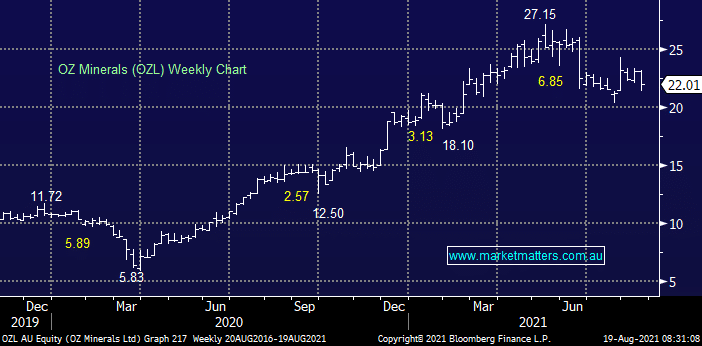

OZL delivered an excellent first half result this week but the stocks struggling to react under the pressure of a falling copper price, they even threw in a nice although small 8c special dividend. We continue to like OZL, over the past 6 years the company has enjoyed growth, earnings and commodity price tailwind plus the companies track record over the same period in terms of guidance & delivery has been “best in class”. The stocks almost become a victim of its own success and is not particularly cheap ~$22, following the pullback in copper, but we remain keen accumulators into further weakness as we believe in sticking with quality ~95% of the time.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM remains a keen buyer of OZL ~$20

Add To Hit List

Related Q&A

What are MM’s current thoughts towards OZL and TPG?

Is OZ Minerals (OZL) a buy?

Does MM think BHP & SFR are buys for battery metals?

Does MM like S32 & / or PLS?

OZL

Thoughts on Lithium & Gold

Identifying stocks to sell

This weeks Commodities Webinar

Should I sell Oz Minerals (OZL)?

Outlook for base metals

MM thoughts on Copper & SFR

Should we get off the reflation trade?

WPL vs BPT, NCM vs OZL

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.