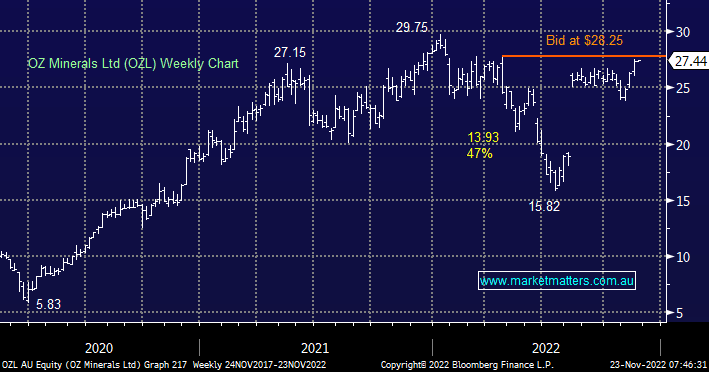

As I’m sure most readers know BHP Group (BHP) has made a “best & final bid” for OZL at $28.25 in a deal that’s unlikely to be complete until Q2 of 2023, BHP is only now starting its 4 weeks of due diligence. The board intends to recommend the bid “in the absence of a superior proposal”, the recent lift was a 13% increase from their previous $25 tilt and is almost a 50% premium to the company’s share price before the bid. Our feeling at MM is this deal will go ahead due to OZL’s excellent fit into both BHP today and where they are headed moving forward. However, the market clearly believes the same making the stock relatively ho-hum value at current levels.

At this stage, it appears hard to envisage a rival bid, who would take on the world’s largest miner in its own backyard without obvious attractive synergies? The last small piece of the puzzle is OZL has retained the right to pay a dividend prior to the conclusion of the deal and with up to A$300m in franking credits (~$A1/share) it would suit many local investors but the cash component would be subtracted from the bid price hence it’s all about the franking which is not inconsequential however there are no guarantees this will go ahead.

- yesterday saw OZL close just 91c/3% below the offer leaving very little meat on the bone, in other words, we wouldn’t be buyers at current levels hence we question whether we should remain long.

- If/when MM takes our profit in OZL it will reduce our copper exposure down to just Sandfire (SFR) hence we may give this position more room than initially planned i.e. any profit part taking above $5 is likely to be small.