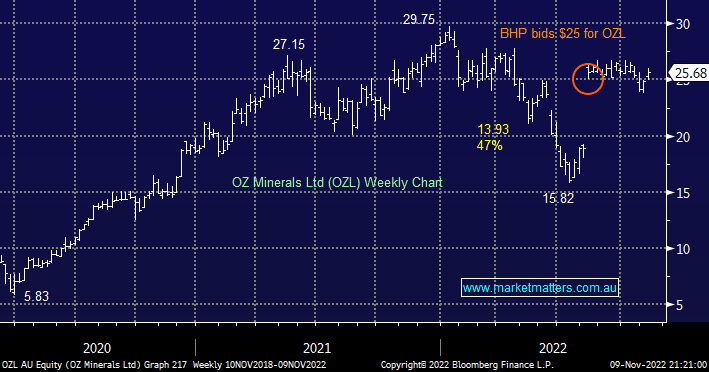

The next logical step for BHP is to increase their offer for OZL towards $30 which is likely to give the big Australian access to the books to fully evaluate its future potential, in the direction of the RIO Tinto (RIO) and Turquoise Hill the numbers appear closer to $40! Obviously, as we’ve seen so often in 2022 BHP could walk now, but we question the message that would deliver for their future-facing commodity strategy – OZL is a current producer, with cashflow and a good balance sheet, an enviable medium-term growth pipeline, and a multi-decade-long cashflow tail.

- We expect BHP to lift their bid above $30 into Christmas.