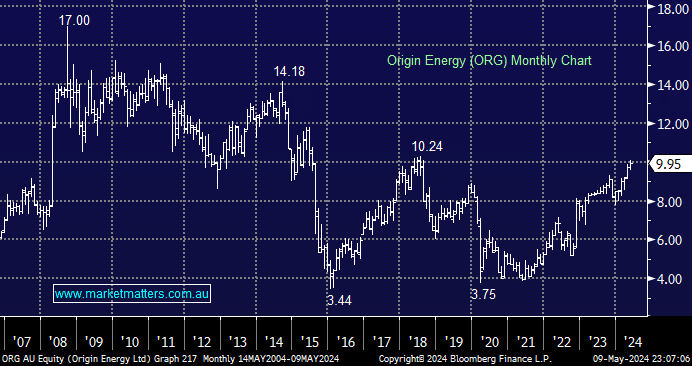

In late April, ORG reported their March quarter operations up with realised prices in line with expectations; however, sales revenue was marginally lower due to lower domestic gas sales volumes. The stock has taken the result in its stride and is making multi-year highs this week. The key takeaway from the result was the continued progress on its energy transition strategy, ramping up its capex profile supporting utility-scale battery developments, as well as signing an offtake agreement for the Supernode battery in QLD, in partnership with Quinbrook Infrastructure Partners’ local data centre complex. – data centres again!

We like the direction ORG is taking, adding further flexible assets to its portfolio as it evolves with the times rather than risk becoming a dinosaur. ORG, trades at 5.1x FY25E EBITDA, around a 6% discount to its five-year average.

- We like ORG around $10 supported by its Est. 5% yield over the coming 12-months – MM is considering ORG for its Active Growth Portfolio.