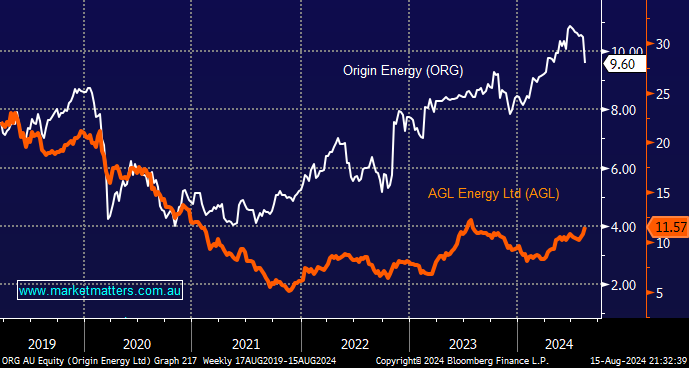

ORG -9.4%: FY24 results were labelled a miss. Analysts compared the $436 million increase in core profit to $1.18 billion, unfavourably compared to AGL’s better-than-expected profit and outlook just 24 hours earlier. Since its result, AGL has advanced +7%.

- FY Net income came in at $1.40bn, a 13% miss on estimates of $1.38bn.

- FY underlying Profit of $1.18bn was a 14% miss on estimates of $1.38bn.

- FY EBITDA was $3.53bn, while ORG will trade ex-div. 27.5c fully franked dividend on September 5th.

ORG’s profits have jumped almost one-third in the past year, but investors were disappointed as the energy giant missed consensus and delivered a weaker outlook. The disappointment was magnified because of the soaring earnings in the energy generation and retailing businesses after customers were hit with higher tariffs to make up for a rise in wholesale costs, i.e. this was a year they should have converted. Also, we feel the 27.5c dividend confirms a flatter dividend outlook, not the growth in capital management expected by the market.

- We believe ORG offers a reasonable value of ~$9.50, but it’s unlikely to be on the MM menu in 2024.

Even after the aggressive reversion of the last 48 hours, ORG is up +25% year-to-date and AGL +16.7%. Following their respective results over the last few days, we expect this performance gap to continue to contract.

- We believe AGL offers better medium-term growth while delivering a yield more likely to rise over time.