There are two important data prints this week in the US that will have a big bearing on where the market heads from here: The US jobs report, and the quarterly result from the world’s largest listed company, and headline act in the AI race – Nvidia.

NVDA reports 3Q26 numbers after the bell tomorrow. Saying this result is the single most important earnings print for global markets this year is not overstating it. It’s the heaviest weighted stock in the S&P 500, Nasdaq 100 and dozens of tech ETFs, and its post-result move will ripple across markets.

The tech giant has beaten revenue estimates for 12 straight quarters and EPS estimates for 11 straight quarters. Analysts again expect another strong print. The bar is high, and market scepticism is building around the durability of AI demand and the industry’s staggering capex cycle. Here’s what’s expected:

- Another Record Quarter with 3Q revenue expected of US$54.84bn, up from US$35.08bn a year ago (would be a record, beating the $46.74bn delivered in 2Q).

- Earnings per share (EPS) of US$1.25, up from US$0.81 YoY

- 4Q Revenue guidance of US$52.92bn–$55.08bn

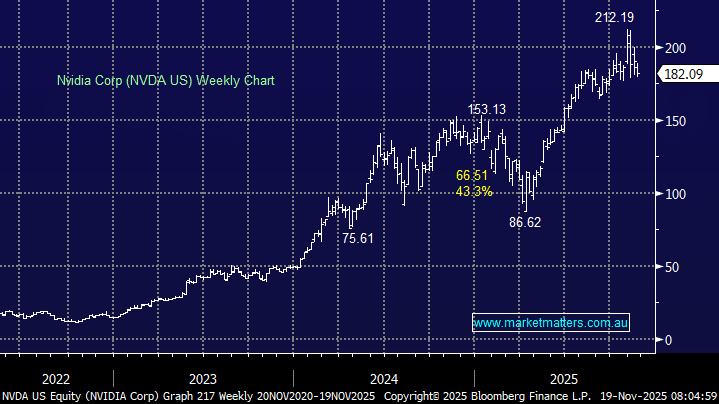

Nvidia has guided to another monster quarter, and the Street expects revenue to land near the top of the range. Clearly, expectations are high and positioning is crowded — NVDA is up +34.8% YTD, although more recently, shares have pulled back ~11% from recent highs. The average move after earnings is 7.4%, meaning volatility is almost guaranteed.

There are no signs that NVDA’s growth is slowing, with the market’s recent concerns driven more by macro uncertainty. The focus tomorrow will be primarily on trying to answer one question – does AI demand remain robust, or are there signs that demand for its chips that power ChatGPT, Google Gemini, Meta’s AI models, Amazon & Microsoft cloud AI infrastructure, Autonomous vehicles, Drug discovery & scientific computing is cooling?

At Market Matters, we’ve written about the multi-decade story of AI as the next industrial revolution, and if that’s the case, demand for their chips, which account for 80–90% of the global AI GPU market, should remain exceptionally strong. If they flag any sort of demand weakness or cracks, then the growth rates implied across the whole sector and associated industries that use their processing power will come into question.

- We don’t think that will be the case, but it’s something we need to be conscious of, and ready to act if that plays out.

While the focus will be primarily on demand coming from data centres and AI, there will be other worthwhile takeaways from the result:

- China Commentary: Export restrictions have limited NVDA’s ability to sell high-end chips into the region. Any update on demand, product redesigns or regulatory shifts will be closely watched.

- Gaming: The segment is smaller than it once was but has been improving (up +14% YoY last quarter).

- Automotive: Often overlooked, but NVDA has posted strong growth recently. This could become a bigger driver as OEMs ramp AI-enabled platforms.

- Supply Chain Capacity: Can NVDA physically meet the world’s AI compute ambitions?

The setup does feel a bit binary. Analysts overwhelmingly expect a beat and raise, but expectations are high even though the stock has lagged broader tech recently. This reflects a growing pocket of scepticism around whether the AI capex cycle can continue at the current breakneck pace, and this concern has prompted several large investors to sell out ahead of this update.

Still, NVDA remains the central player in the AI arms race. If Jensen Huang delivers bullish guidance, especially around Blackwell demand, China workarounds, and supply chain ramp up, this could be a positive catalyst for tech into year-end, and therefore, the market more broadly.

- While we don’t own NVDA in the International Equities Portfolio, many of our positions, and the market more generally, are directly linked to the pace of AI adoption and therefore the demand for NVDA GPUs that power it.