NVDA delivered another very solid set of numbers after market, the likes of which the ASX can only dream of at the moment, for the second-quarter:

- Revenue was $US46.74bn, +56% YoY, above $US46.23 consensus estimates.

- Adjusted gross margin 72.7%, above the 72.1% estimate.

- Adjusted EPS $1.05, above the $1.01 estimate.

- Free cash flow of $US13.45bn, -0.2% YoY.

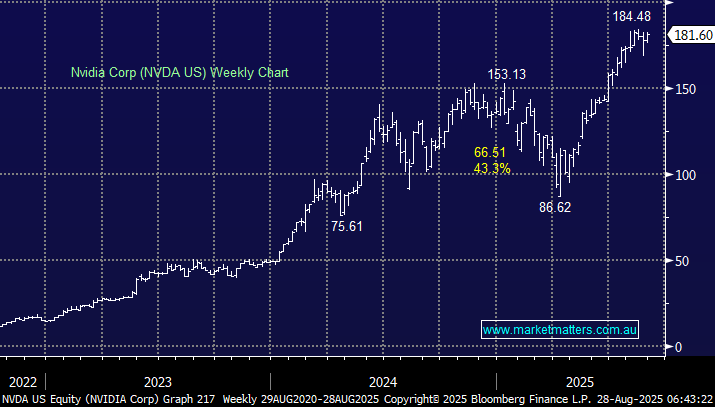

The past quarter was solid, beating on most metrics, however, NVDA’s shares fell by as much as 5.4% in after hours trade after the chipmaker forecast sales in the 3rd quarter of $US52.9-55.1bn, which failed to impress a hungry and expectant market. The company also approved an additional $US60bn buyback – more than the entire market cap of Macquarie Group (MQG) or Goodman Group (GMG). Importantly, didn’t assume any H20 shipments to China with their gross margin forecast between 73% and 74%,

- We believe this was another good result from NVDA, and the stock will attract plenty of buying into dips.