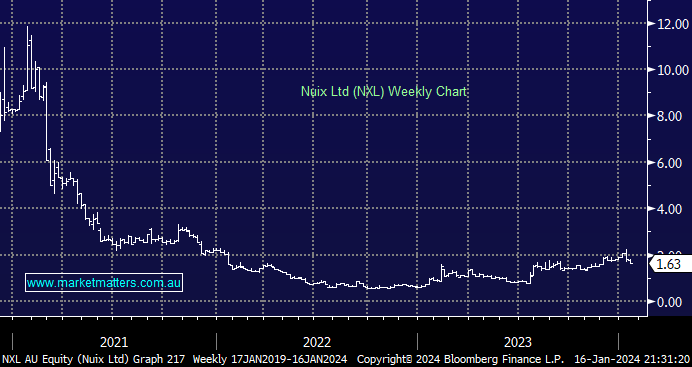

The data analytics software company hit two-year highs last week; however, the stock has already fallen ~20% following a trading update released on Friday the 12th. The update, in our view, was more positive than the market has given the stock credit for and looks to be another data point that shows the progress that the company has made after a few lean years with multiple distractions.

Annualized Contract Value (ACV) is expected to be up 15-17% to $196-199m, well on track to meet the FY24 target of 10% growth in constant currency terms (~$204m). Underlying EBITDA is expected to be $27-29m, already covering ~80% of the full FY23 result. The company reiterated guidance – ~10% ACV growth & revenue growth to exceed operating cost growth for the year while legal fees look to be past their peak and the company puts a number of long-running issues behind them.

Shares fell 13% on the day of the release and have continued to slide since. The market was likely expecting an upgrade at the trading update, which didn’t eventuate; the stock was up ~20% in the week prior, a sign of exuberance ahead of the announcement. This update and pullback have NXL firmly on the radar for the Emerging Companies Portfolio – it currently resides in our Hitlist.