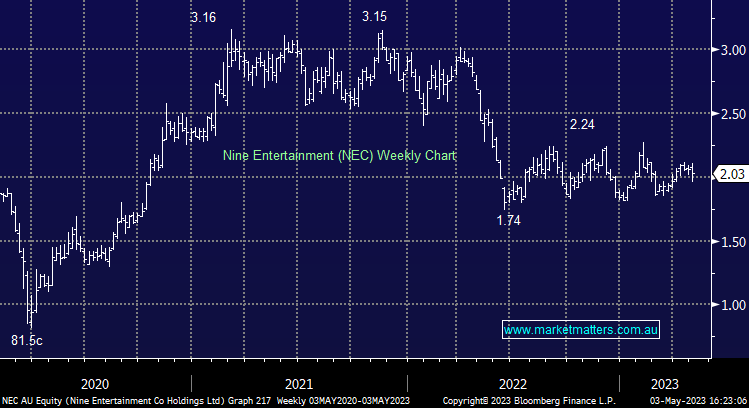

NEC flat: one of many to present at the Macquarie Conference today, providing EBITDA guidance for the first time which fell short of expectations. The company said the advertising market declined 15% in the 3rd quarter, but they managed to pick up more than 2.5% in market share. They also expect a similar result in Q4 with a weak market partially offset by gaining market share across each of their platforms against their traditional rivals. Overall they expect to see EBITDA between $590-600m for the full year, ~5% below consensus. Despite the miss, Nine remains exceptionally cheap and shares outperformed the broader market today.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is long and bullish NEC

Add To Hit List

In these Portfolios

Related Q&A

Nine Entertainment Co Ltd (NEC)

Nine Entertainment (NEC) and Southern Cross Electrical (SXE)

NEC and APX

AMP, WOW, NEC

Is the market getting it wrong on NEC?

Will Media company be in focus for coming financial year ?

Your thoughts on CTD and NEC, please

MM view of NEC & HVN

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.