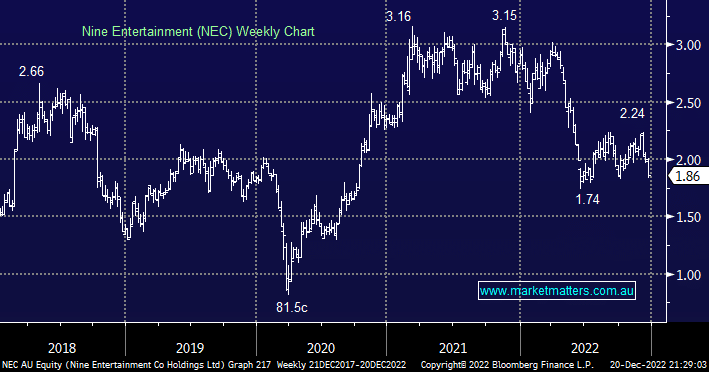

The downgrade by Domain Holdings (DHG) yesterday on the back of weaker listing volumes created some wider peripheral damage, with REA Group (REA) and Nine (NEC) also feeling the repercussions. In terms of NEC which we own in our Emerging Companies Portfolio, they own 60% of DHG and are directly impacted. DHG made up ~14% of NEC’s earnings in FY22 and simply extrapolating the impact of DHG’s 20% downgrade on 1H23 guidance, it would hurt NEC’s earnings by ~3%. NEC also went on to flag a toughening advertising market although other parts of the business are doing well, and they retained their 1H23 guidance, for EBITDA of around $370m in the 1H.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains bullish and long NEC despite recent weakness

Add To Hit List

In these Portfolios

Related Q&A

Nine Entertainment Co Ltd (NEC)

Nine Entertainment (NEC) and Southern Cross Electrical (SXE)

NEC and APX

AMP, WOW, NEC

Is the market getting it wrong on NEC?

Will Media company be in focus for coming financial year ?

Your thoughts on CTD and NEC, please

MM view of NEC & HVN

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.