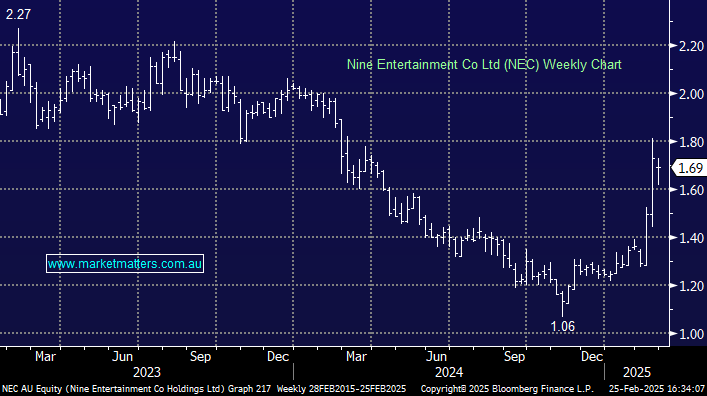

NEC +3.68%: Reported a softer operational result year-on-year, in-line on revenue but impressing on guidance around cost-control and efficiencies moving forward.

- Revenue $1.4bn, +1.6% yoy vs. $1.42bn consensus

- Net profit $96mn, -15% yoy

- $50m targeted cost-efficiencies for FY25, $10m-$20m to be realised in FY25, with long-term efficiencies through FY27 forecasted at ~$100m.

Nine anticipates further restructuring into 2H25 and FY26, with ongoing cost efficiencies supporting profitability. Broadcasting revenue is forecasted mid-to-high single-digit growth though ad revenue is expected to decline to high single digit growth, so a solid outlook from a sales perspective.

Management reiterated their stance on the sale of Domain i.e will consider CoStar’s proposal with a focus on best interests to shareholders… we’ve heard that one before and we know given its strategic value, it will not be given up easily.