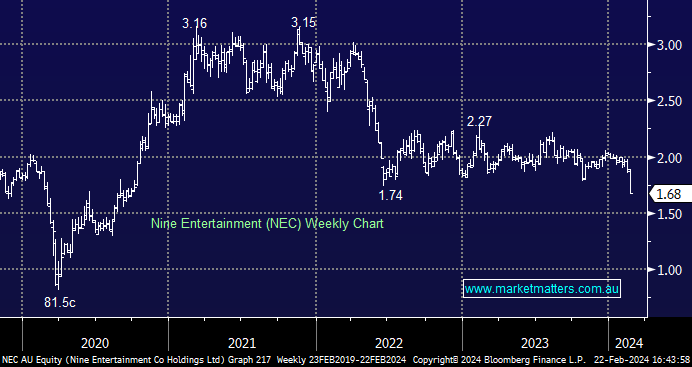

NEC -8.70%: the media group posted strong 1H numbers today, however, a marginally disappointing outlook weighed on shares. Revenue was a slight beat, however EBITDA was ~4% ahead of expectations at $316m vs $302m. TV, including 9Now, met expectations, Radio was a small miss made up by a small beat in publishing, while Stan continues to beat expectations. The issue came with free to air (FTA) outlook which pointed to a small decline in market share while the market still faces declining volumes. Nine did lower cost expectations which, in our view, should have helped offset the disappointing revenue expectations.

- NEC remains cheap and harshly dealt with today despite some solid numbers.