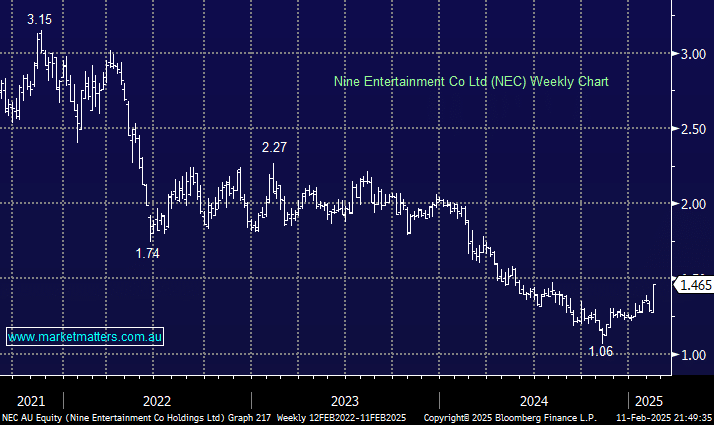

A week after UBS downgraded Nine Entertainment (NEC) to Neutral from Buy, a positive update from Seven West (SWM) prompted a big re-rate in media stocks, with Nine up +14% yesterday, smashing UBS’s new 12-month target less than a week after they published it. The commentary from SWM yesterday was ‘sort of’ upbeat and signalled a return to revenue/earnings growth in the 2H. They are experiencing solid Q3 booking volumes, and while they are coming off a very low base, the 2H benefits from an increase in sports coverage.

- This is a very positive read-through for NEC, with the owner of Nine, Stan, The AFR, Channel 9, and a major stake in Domain, which is due to report earnings on the 25th of February.

We’re expecting a slight increase in revenue HoH but higher costs will continue to weigh on earnings, expected to be down ~10% on last year at around $100m. Continued cost out, along with their progressive move towards a digital platform business relative to an older style media business, is what will drive NEC shares from here, and if they also get the tailwind of an improving backdrop for advertising, that would come as a surprise to the market. It’s depressed, unloved, and susceptible to ‘less bad’ news, as we saw yesterday.

At their FY24 results in August, we said at the time that free-to-air TV overall is in decline while connected TV is on the rise. While NEC is exposed to traditional TV through Nine, their audience had troughed and was stable rather than still declining, while other areas are growing. We think this should create an inflexion point, with these results important.

- Looking beyond FY25, we expect a solid improvement in earnings, which drives down the valuation.