NEC held an investor day last week to cover life after the sale of Domain, where Management doubled down on the strategy of extracting more value from its Digital assets – particularly Stan, 9Now, and Digital Publishing (with the AFR a standout performer). The company also highlighted longer-term upside from AI-driven content monetisation and digitisation of archival news assets.

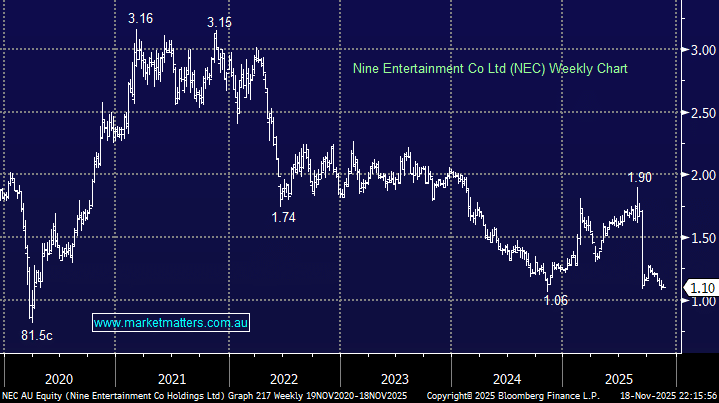

However, NEC still relies heavily on Broadcast TV, which represents around 40% of group earnings, and management again flagged weaker ad spend from Retail and Government categories. With the ad market still soft, the stock continues to trade at ~7x forward EBITDA, around 1 standard deviation below its 5-year average – a discount we see as justified given ongoing pressure in traditional TV revenue.

It wasn’t all bad news, though. An area of promise is how they’re achieving a better return on content by managing the releases across their various assets – free to air (FTA), 9Now and Stan – with highlighted examples being;

- Moving Love Island USA off FTA and exclusively to Stan delivered a +20k subscriber uplift – arguably, a poor reflection of our society!

- Premier League matches on FTA helped lift awareness and funnel viewers towards Stan Sport for more action

- Airing season 1 of Bump of FTA, to boost subs on Stan for the release of season two, which is not available on FTA (= +3k adds to Stan).

The other area is digital subscription revenue, with the AFR being the star performer. They grew digital at 16%, with 73% of AFR revenue now coming from online subscriptions, which underpins better margins.

- Overall, we think NEC are doing a good job with what they have; it’s just the structural shift away from FTA is still having a decent impact.