NCK +0.97%: a choppy day for the furniture retailer, but shares closed higher in the end reflecting the small beat. Revenue was down 5.4% on last year to $180m, though earnings fell 6.6% to $35.6m in the half as various COVID related costs jumped – store closures & supply chain disruptions the culprits. Earnings are on track to meet full year expectations however Nick Scali will get the benefit of a full half contribution from Plush-Think Sofas which they acquired mid-way through the first half. Plush contributed $31.5m to sales in the 2-months since the deal completed. The business will need to continue to manage supply chain issues with the outstanding order book continuing to grow in January, however they’ve done well to at least maintain the bumper sales levels from the previous period.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

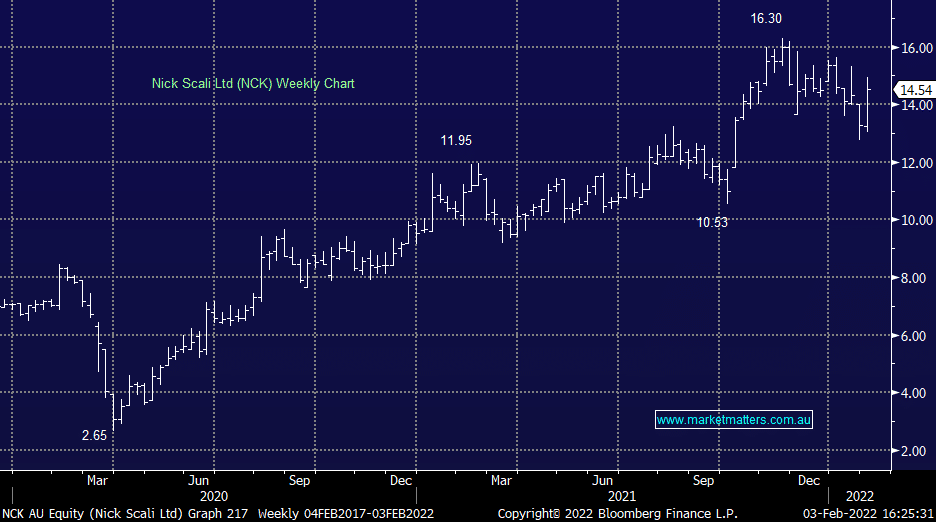

MM likes NCK as a top quality retailer, but we’re neutral/negative the sector here

Add To Hit List

In these Portfolios

Related Q&A

SPP for NCK

Do you like Nick Scali (NCK) and retail into 2024?

Retail Stocks – Are they a buy yet?

Our thoughts on Nick Scali Ltd (NCK) around $10

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.