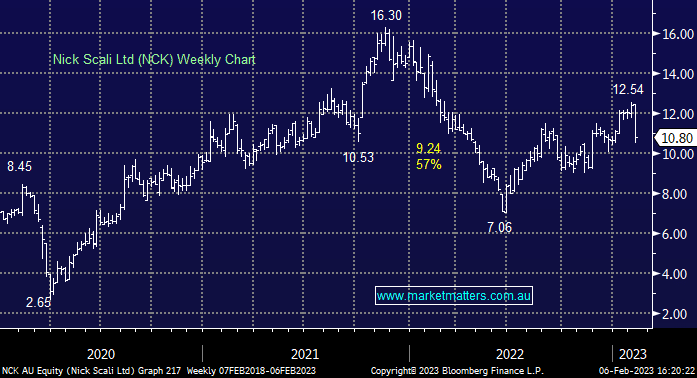

NCK -13.04%: the furniture retailer announced 1H results today with a strong 6-months unable to offset lacklustre commentary. Revenue jumped 57% to $284m, helped by improving delivery times and a full contribution from Plush which was acquired in 2021. EBIT was up 66% to $91m with the margin improving 150bps, and net profit was up 70% to $60.6m. The Plush integration seems to have been successful with $20m of annualized synergies now realized and integration of the Nick Scali sales model and point of sale operations improving conversion rates in the business. Much of the market’s issue was with comments around the 2nd half of the year with the company failing to provide FY guidance while saying January sales were down 12% on last year despite being “better than expected.” If the expectation is for sales to fall 12% in the back half of the year, Nick Scali will fall well short of current consensus which is for revenue of $493m and net profit of $95m.

scroll

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is bearish NCK ~$11

Add To Hit List

In these Portfolios

Related Q&A

SPP for NCK

Do you like Nick Scali (NCK) and retail into 2024?

Retail Stocks – Are they a buy yet?

Our thoughts on Nick Scali Ltd (NCK) around $10

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.