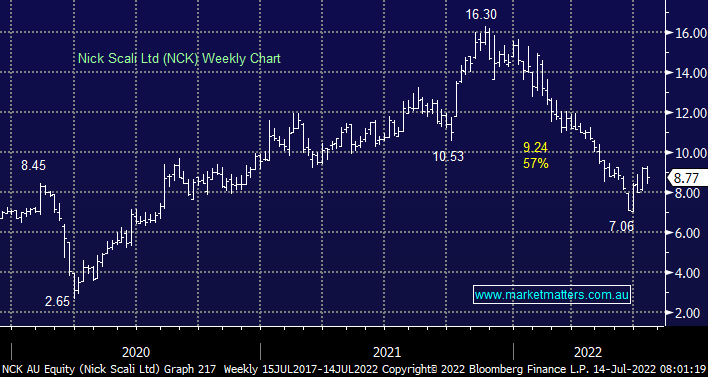

Quality furniture operator NCK has endured a number of headwinds over the last 12-months including delivery issues due to escalating Covid problems in China, a cautious consumer as interest rates rise and a slowing housing market. However, when things look their worst opportunities arise and we feel NCK is setting itself up to be such a situation after it’s more than halved since late 2021. Again the stock ‘s cheap trading on a 9.2x Est. 2022 while its estimated yield of 6.5% is clearly attractive.

- Like the overall sector we feel that NCK is looking for a low but the risk/reward will look particularly attractive if / when the stock makes fresh 2022 lows.