NSR FY25 results will be released in August, and with higher occupancy levels and an increase in net asset value (NAV) due to lower capitalisation rates, a “beat” wouldn’t surprise MM. With rival Abacus Storage Kings’ rejection of the bid from Ki Corp and US giant Public Storage (PSA US), the short-term future of the local storage space looks a touch clouded, but with both NSR and ASK trading around their 2025 highs, things look encouraging. ASK could push for a higher bid, but NSR’s presence on the register with 12.8% voting rights raises the question as to whether the consortium would have the risk appetite for a unitholder vote, knowing that a proposed resolution could be defeated – perhaps PSA who clearly have interest in the Australian market will reconsider NSR, which it had a tilt at five years ago.

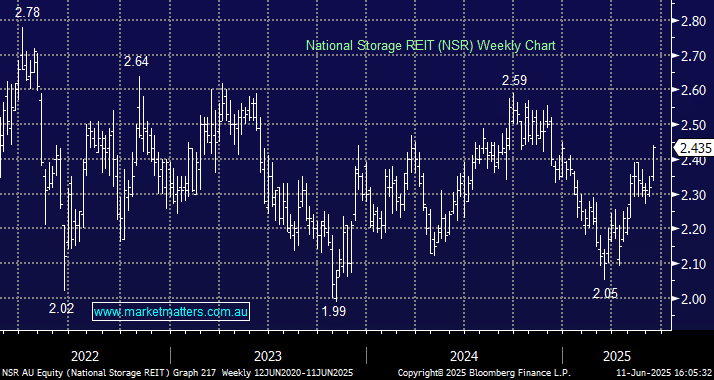

- We are initially looking for another test of the $2.50-60 area, or ~5% higher: MM is holding NSR in its Active Income Portfolio and Active Growth Portfolios.