NSR closed up +2.2% on Wednesday, relishing in the CPI figure which should lead to rate cuts and a potential increase in net asset value (NAV) when the storage company reports in August. Ki Corporation (Nathan Kirsh’s family office) and U.S.-listed Public Storage (PSA) have been allowed access to Abacus Storage Kings’ (ASK) books after the consortium sweetened its proposal to $1.65, still at a slight discount to the high-end NTA estimate of $1.73/share – NSR has a vested interest holding 8.3% stake in ASK. They may be after a better bid or to stymie the takeover to prevent a well-capitalised US competitor from entering the gates, an interesting story either way.

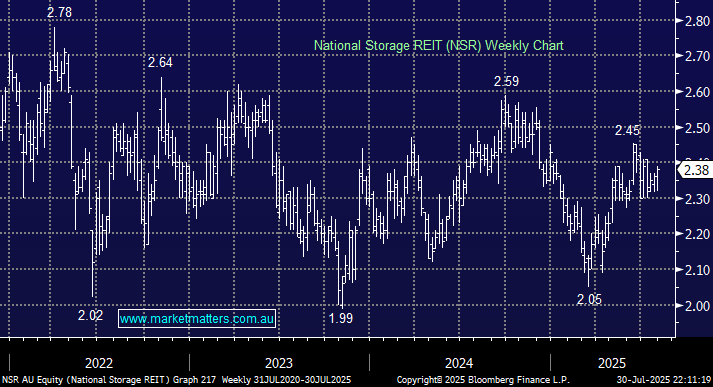

- We remain bullish NSR initially targeting the $2.60 area, 8-10% higher. MM holds MGR in the Active Growth and Active Income Portfolios.