NSR recently bought a “blocking” 5% stake in Abacus Storage King (ASK), making us ponder whether they want to avoid competition from massive US player Public Storage and/or if they’re thinking, “If you’re going to come, we want to make some easy money on the way.” So far, NSR has said they have no plans to make a competitive bid, which would dent NSR’s share price at least in the short term. If the takeover of Abacus by Ki Corp and partners fails, it’s likely to be good news for NSR. Arguably, they have put themselves in a relative win-win situation.

Like much of the real estate sector, NSR pays a nice dividend around 4.6%, though it’s unfranked, which again provides a tailwind for the stock while credit markets are looking for cuts into Christmas. The main short-term risk is if they decide to bid for ASK.

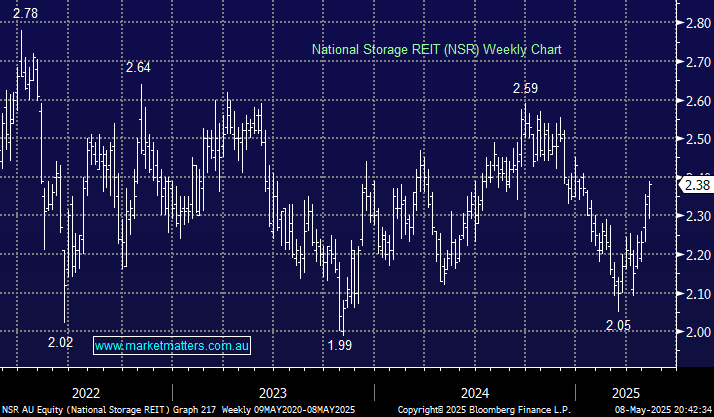

- We are bullish on NSR, initially looking for another test of the $2.50 resistance area: we hold NSR in our Active Growth Portfolio and Active Income Portfolio.