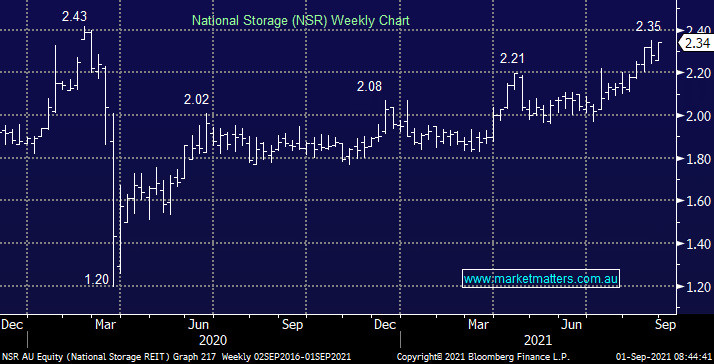

Storage is a hot commodity at the moment with both Abacus (ABP) who hold interests via Storage King and National Storage (NSR) who is Australasia’s biggest reporting very high occupancy and demand resulting in strong earnings. When NSR reported FY21 earnings last week they delivered a solid result on all key metrics plus importantly they upgraded their FY22 profit guidance saying that NPAT would be at least $110m, a ~3% upgrade at the time, that number also seems a conservative one. Of course higher earnings flow through to higher dividends however following it’s run in share price, the projected yield on NSR is now 3.63% unfranked.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

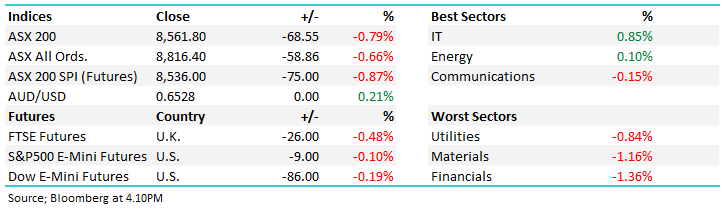

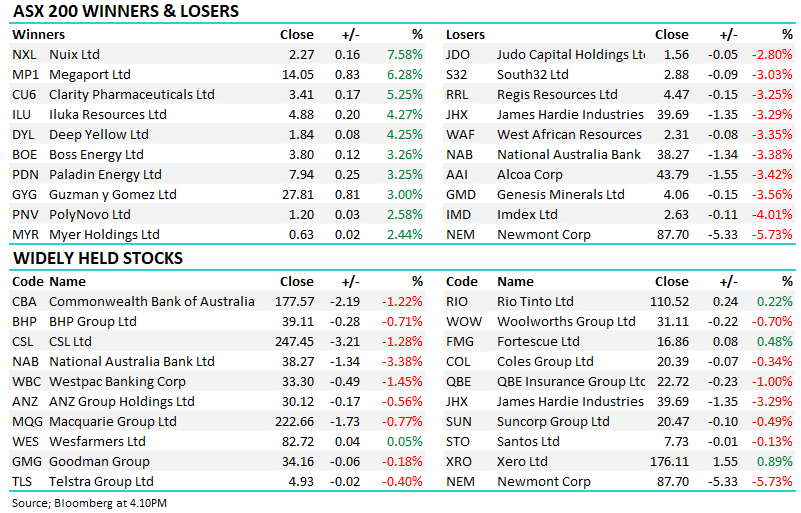

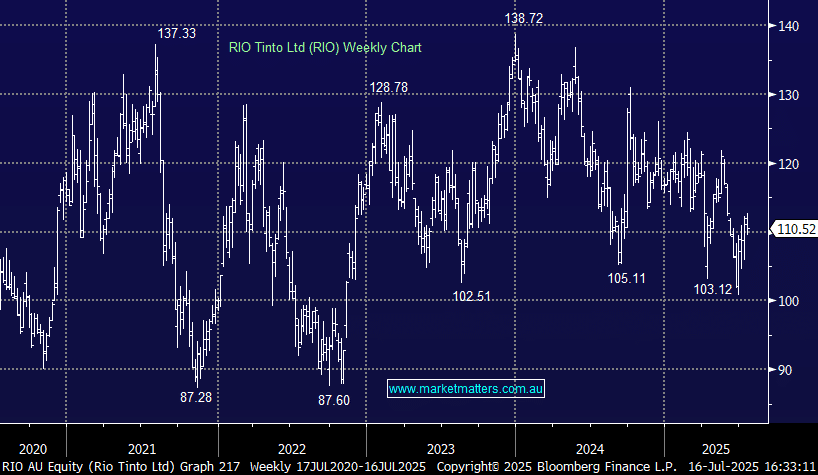

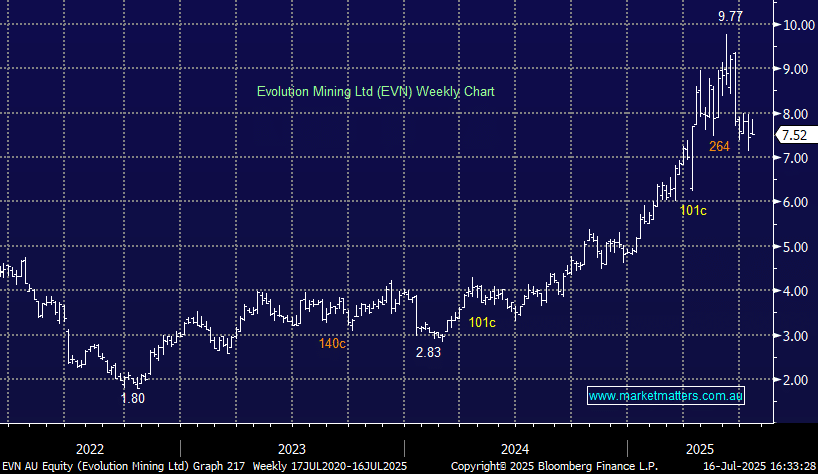

Wednesday 16th July – ASX -73pts, EVN, RIO, NEM

Wednesday 16th July – ASX -73pts, EVN, RIO, NEM

Close

Close

Wednesday 16th July – Dow off 436pts, SPI down -66pts

Wednesday 16th July – Dow off 436pts, SPI down -66pts

Close

Close

MM has switched to a neutral stance on NSR around $2.34

Add To Hit List

In these Portfolios

Related Q&A

NSR JV Plan

Thoughts on a2 Milk (A2M) and National Storage (NSR)

Thoughts on Aristocrat (ALL) and National Storage (NSR)

Update of MM’s Webinar – “Pulse check 7 Highest conviction calls”

How much further can real estate stocks appreciate?

REITS

Does MM have a preference between CNI and NSR?

MM updates on DXS, NSR and ABB

Which REITS have the most capital upside?

What are MM’s current thoughts on ABG/ASK and NSR?

What stocks for property exposure?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 16th July – ASX -73pts, EVN, RIO, NEM

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 16th July – Dow off 436pts, SPI down -66pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.