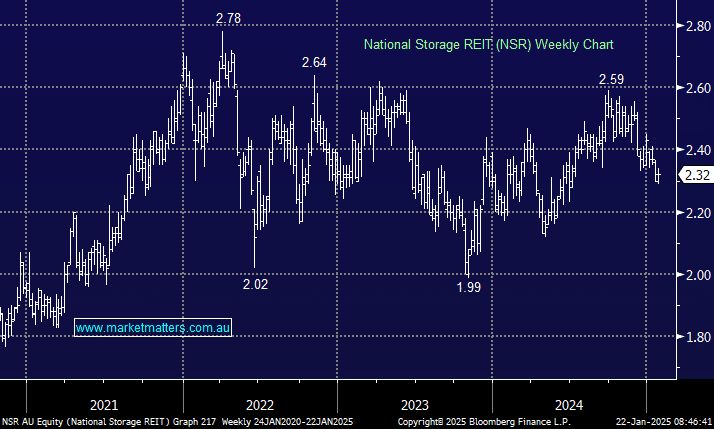

Australasia’s largest self-storage provider has come under pressure since bond yields started rising in September 2024. From that point, US 10-year yields, the globally recognised proxy for interest rates, rose from 3.62% to 4.80%, pushing NSR from a $2.59 high back to a low this week of $2.29, a ~12% pullback. While there is a clear link between property stocks and the trajectory of interest rates, and the sector has been under pressure across the board, we are about to enter reporting season, so it pays to revisit earnings assumptions ahead of their 1H results due for release on the 21st February.

We remain bullish on NSR earnings growth underpinned by continued storage fee rental rate growth and largely stable like-for-like occupancy. Growth then kicks in further from a large pipeline of development work underway, with circa 20 projects under construction and 3-4 completions happening during the period. This does impact headline occupancy as a new facility initially starts at lower levels before stabilising to higher average levels over time however it will drive future growth. The impact of bond yields/interest rates is obvious; however, we think finance costs have peaked and will start to reduce as interest rates decline and lower-cost sources of funding are utilised. NSR uses a low level of interest rate hedging.

On valuation, NSR trades on an ~8% discount to Net Tangible Assets (NTA), with the reported NTA supported by evidence of sector transactions. Further, NSR trades on ~18x FY26 earnings and will yield over 5%, importantly, with some growth. We expect earnings growth of 5% over the next 3 years driving growth in dividends at the same rate.

- We view NSR as a stable defensive stock, trading at a reasonable price with a strong long-term growth profile in a sub-sector of Aussie REITs that also has structural tailwinds.