NSR confirmed yesterday that it had purchased a 4.78% stake in $1.9bn rival Abacus Storage King (ABK). Still, it does not plan to make a rival bid for ABK, which is already under offer from a South African Billionaire via a consortium formed between Nathan Kirsh’s family office, Ki Corporation, and New York-listed giant, Public Storage. Interestingly, NSR said it considered ASK “a compelling investment at the prevailing price”, noting the consortium’s offer was ~9% below ASK’s net tangible asset value. This is a fascinating play by NSR, who could be looking to thwart/block the move by Public Storage & Co, the very company that bid for NSR around Covid time.

When we compare the two rivals, we could question why NSR would not simply buy back its own stock, all else being equal. In good Sherlock Holmes fashion, it feels like “The Game is Afoot. “Following yesterday’s comments, NSR is unlikely to bid for ASK, but its ~$92mn bet looks far more than a value play, which would have made far more sense earlier in the year. Our best guess is they might try to put a spanner in the works to avoid competition from a bigger, more powerful competitor – Public Storage (PSA US) has a whopping market cap of ~$80bn.

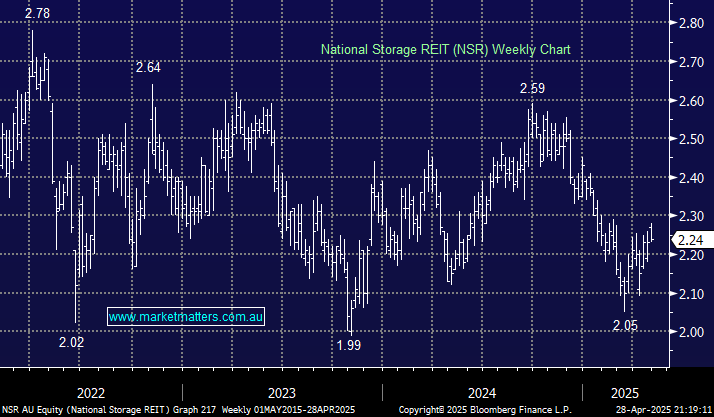

- NSR is a $3.1bn business trading on an Est P/E of 19.3x while it yields 4.9%, the stock is trading ~12% below its NTA.

- ASK is a $1.9bn business trading on an Est P/E of 22.5x while it yields 4.25%, the stock is trading ~9% below its NTA.