NSR is very well positioned after its recently announced Ventures JV with GIC, which should provide short-term earnings support as NSR ramps up on the development front – this self-storage REIT remains one of our core holdings in two portfolios, liking both its 4.3% sustainable yield and strategic direction.

With higher-density living being the easy way for the government to get close to its new home goal, storage will become an increasing requirement in people’s lives. We should also remember the stock was “in play” a few years ago, with New York-listed storage giant Public Storage and Gaw Capital having a tilt at NSR; with interest rates falling, it feels like now or never if they are going to try again – not a reason to buy but some potential cream.

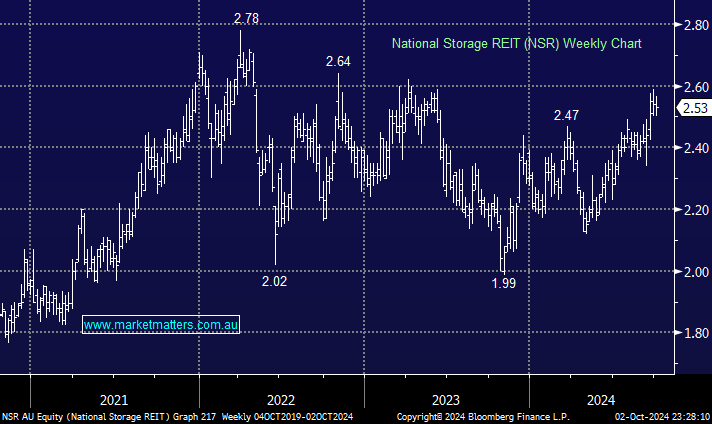

- We can see NSR testing its highs as rates start to decline, initially ~10% higher.