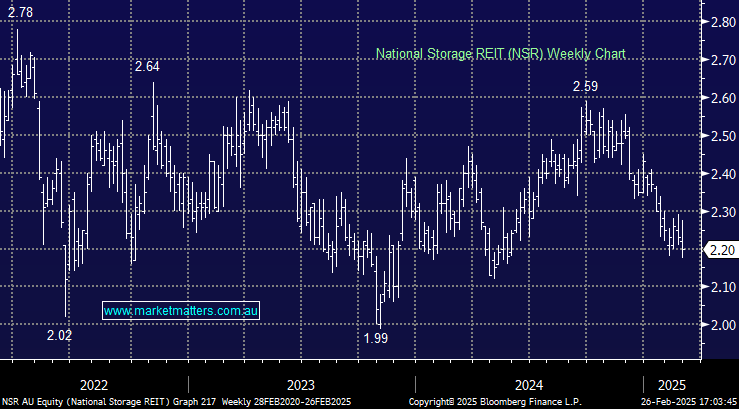

NSR -2.22%: The storage provider announced solid results that were broadly in line with expectations, whilst reaffirming guidance for the full-year though the stock drifted lower due to softness in occupancy rates in the near-term.

- Revenue $190m, +9.5% yoy

- Net profit $87.9m, +11% yoy

- Overall occupancy down 3.6%

- Interim distribution of 5.5cps, flat yoy

Guidance for the full-year was reaffirmed at EPS of 11.8c or $163m with momentum in revenue per available square metre (REVPam) of 3.5% and rental growth of 8.5% in the first half expected to continue moving forward. Whilst occupancy was down, this comes back to their current portfolio mix – a large proportion of these require stabilisation over a 3-year period and are not yet matured but achieve higher growth thereafter.

NSR’s ramp up continues, evidenced by the addition of 7 new developments completed during 1H25 which should generate ~$15m revenue p.a once stabilised. NSR still trades at an 11% discount to NTA of $2.53 and will pay a ~5% yield as it maintains its policy of 90-100% payout ratio.

We own the stock in both our Active Growth and Active Income portfolios.