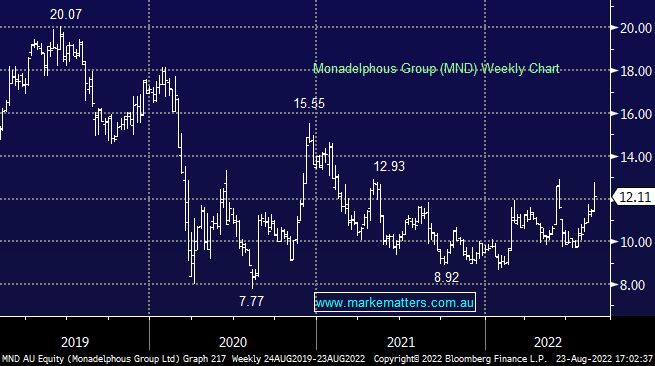

MND +5.86%: FY22 was better than expected across most key metrics, EBITDA of $111m compared to $104m forecast while NPAT of $52.28m was around an 8% beat to consensus and up 11% YoY. They said the outlook for core markets continues to be strong, with the mining services company flagging a strong capex outlook in iron ore, battery metals and LNG, which supports the longer-term growth outlook for maintenance services. One trend we’ve seen in recent times is the miners guiding to lower dividends and more $$ in the ground, and companies like MND & NRW Holdings (NWH) will likely be the beneficiaries here.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral /bullish MND ~$12

Add To Hit List

Related Q&A

Buy, Hold, Sell – CWY, MVF

Reporting update on 3 stocks- CRN, CAJ and MVF

Why did MM choose WOR over MND?

When a stock is not marked ‘Active’

Our view on NRW Holdings & Monadelphous Group (MND)

MM stance on Monadelphous (MND)

Monadelphous Group (MND)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.