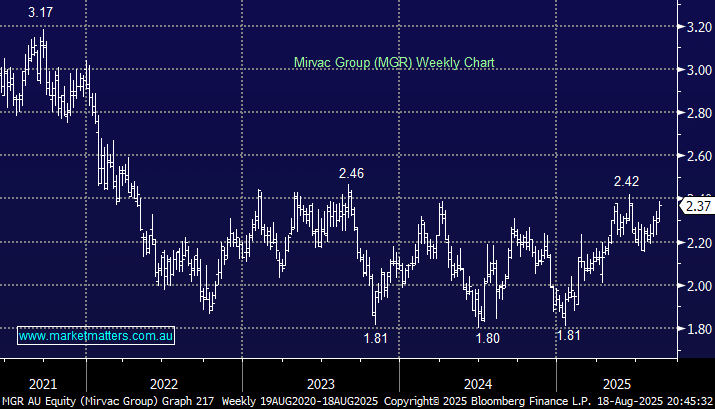

MGR enjoyed a solid +3.5% advance on Monday, making it the standout performer in the real estate sector and taking its gain in 2025 to over 26%. The reason for the move was an upgrade to a Buy by Citi, targeting $2.60, or ~10% above Monday’s close. We also liked MGR’s forecast for EPS growth in FY26, stronger residential sales, the solid performance of Mirvac’s investments division, and a growing funds platform. The 4% yield and the stock trading within 1-standard deviation of its average valuation in a rich market remain encouraging, with rates set to fall. The bottom line being that FY26 is set to be a turnaround year for MGR following a lacklustre few years.

- We initially see MGR testing above $2.50 into 2026: We own MGR in the Active Growth Portfolio.