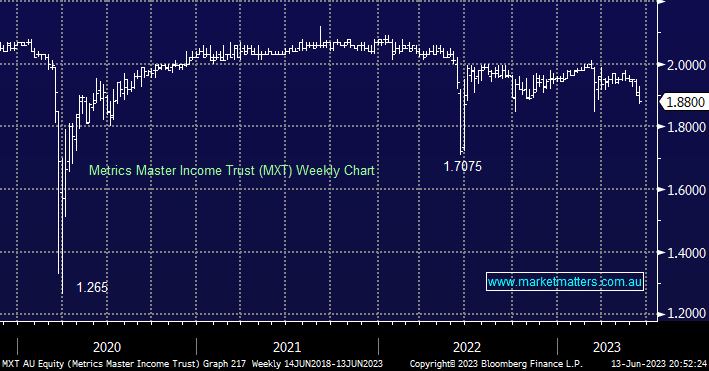

One of our core principles at Market Matters is understanding what we’re investing in, and having a strong handle on what will drive that investment’s performance over time. MXT has been held in the Active Income Portfolio since it was listed in October 2017 and they’ve exceeded their objective (RBA cash rate +3.25%), with our position up ~18%. As a refresher, MXT is a listed trust that provides exposure to a diversified portfolio of direct loans to Australian corporates, managed by Metrics, which has around $13bn of funds under management (FUM). They’re good operators, however, we are now questioning our holding in MXT for several reasons:

- The visibility of their underlying exposures is low. While it is a diversified portfolio with over 300 loans, the composition of its portfolio seems to be changing, adding risk that we are less comfortable with.

- The portfolio holds a mix of investment-grade and non-investment-grade exposures. Their investment grade exposure has averaged ~57% since 2017 – currently, this proportion sits at just ~48% – its lowest level since listing.

- Exposure to Real-Estate by lending to REITs and property developers/managers has averaged ~43%, which has now crept up to ~54%, its highest level of exposure since listing.

- Sub-investment grade loans have a higher level of default risk associated with them, and we are mindful that defaults generally tend to cluster during periods of prolonged economic distress.

Considering the declining interest rate environment since MXT was listed, and despite the disruption from COVID-19, the credit environment has been a strong one given the huge amounts of liquidity being injected into the market. The trust has not been tested in tougher conditions, and with rates up 4% since their lows, this is clearly a ‘testing’ environment where defaults, particularly in the Real-Estate sector seem probable to MM. Entering this period, with, from what we can see, the highest level of risk since listing does not sit well with us.

We could draw on the stability of their Net Asset Value (NAV) per security which is currently $2 and has been every month since listing, as a positive anchor point, however, unlike a publicly traded bond, where the value of the asset is determined by its traded price, MXT’s portfolio will largely comprise loans where a traded price does not exist. The NAV is based on Manager’s internal loan valuations, and while there is external oversight and audit, its NAV is not tested by the market.

Last week we saw Dexus (DXS) sell the 26-story 44 Market Street in Sydney for $393m which was a 17% discount to the ‘independent’ valuation they received in December 2022 which flows into the book value they use for the asset. While it was a weak price, Dexus (DXS) is trading at a ~25% discount to its assets, implying the market, MM included, understands that assets in a general sense are not worth their carrying values.

When we package these data points up, and overlay our pragmatic approach to investing, we pose the question, do we really need to be holding MXT?