Hi Sidney,

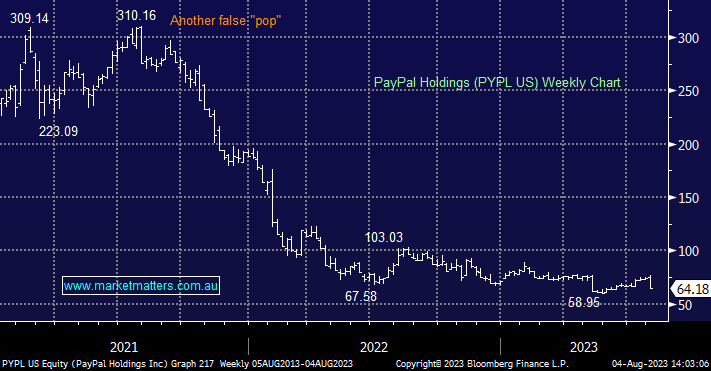

PayPal (PYPL US): Payment platforms are a rapidly evolving industry with PYPL having lost its 1st player advantage, most certainly from a share price perspective. This increased competition was initially illustrated by PYPL’s earnings report in May when volumes beat by ~3% but earnings only beat by ~1% i.e. margins were an issue. Similarly this months earnings appeared to beat estimates but again the stock fell away on margin metric misses – a disappointing trend has evolved.

- PayPal’s stock has fallen ~15% this week on poor margins, however safe the platform is we regard the stock as too hard from an investment perspective for now. They need to show they can grow earnings, not just revenue.

Metrics Master Income Trust (MXT): On face value, this is a very defensive investment, with the value of their underlying portfolio hardly changing. They hold commercial loans with around 60% exposure to property. We had the team from Metrics in last week and they have clearly grown a phenomenal business (now manage ~$15bn) delivering strong & consistent returns, however, we don’t think MXT is as safe as its nameplate implies, and we wrote about this a couple of months ago here.

Using your scale and having equities at 1 and cash at 10, we would put metrics around 4-5 simply given the lack of transparency in their underlying portfolio and their skew towards property.