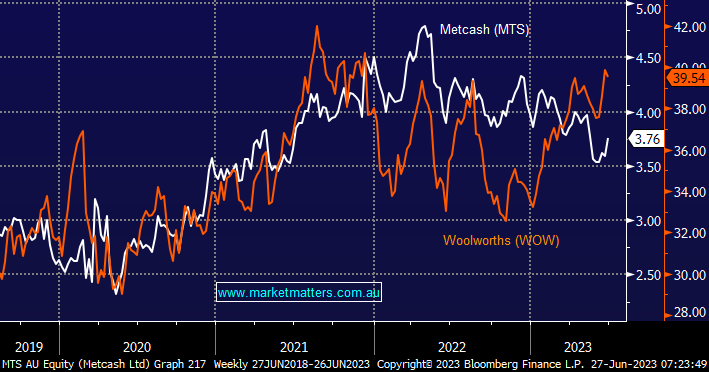

MM covered MTS yesterday afternoon, we believe the solid result should help placate the market worries around customer retention after COVID lockdowns and the transition of cash-strapped shoppers to cheaper options such as ALDI. While scale is a very important buffer when times toughen, and for this reason, Woolworths (WOW) is the preferred play of many fund managers, we believe these scale benefits are more than captured in the price, with WOW trading on 26x FY24 earnings while Metcash languishes on just 12x.

- We believe MTS is looking cheap compared to its peers i.e. MTS is -23% below its 2022 high compared to WOW at only -7%.

- We are watching MTS carefully for our Growth Portfolio following yesterday’s solid result.

We believe MTS is well-positioned for an economic downturn due to its diversification from IGA to Total Tools, Mitre 10 and various liquor options making it a stock to watch if negative sentiment drives it lower.